A range of ready-made portfolios with different levels of risk

If you’d like an easy way to start investing, you could choose one of our ready-made diversified portfolios.

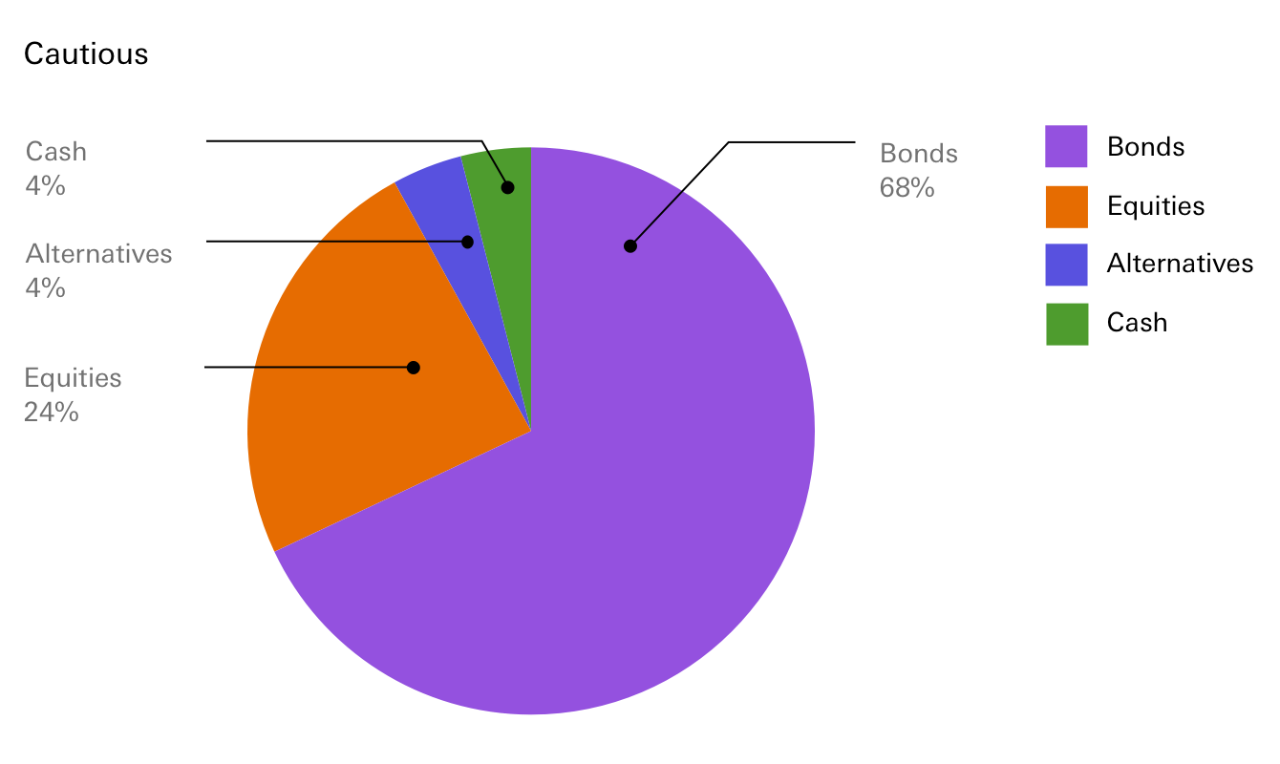

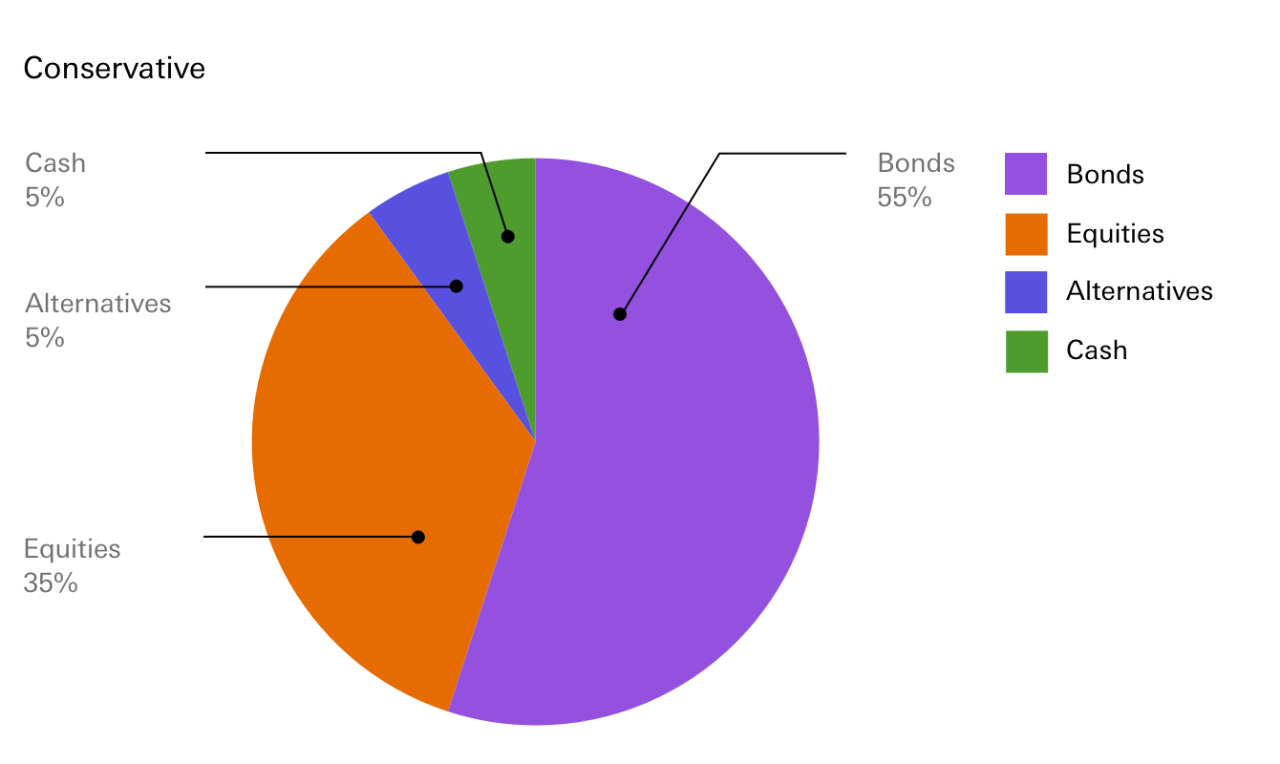

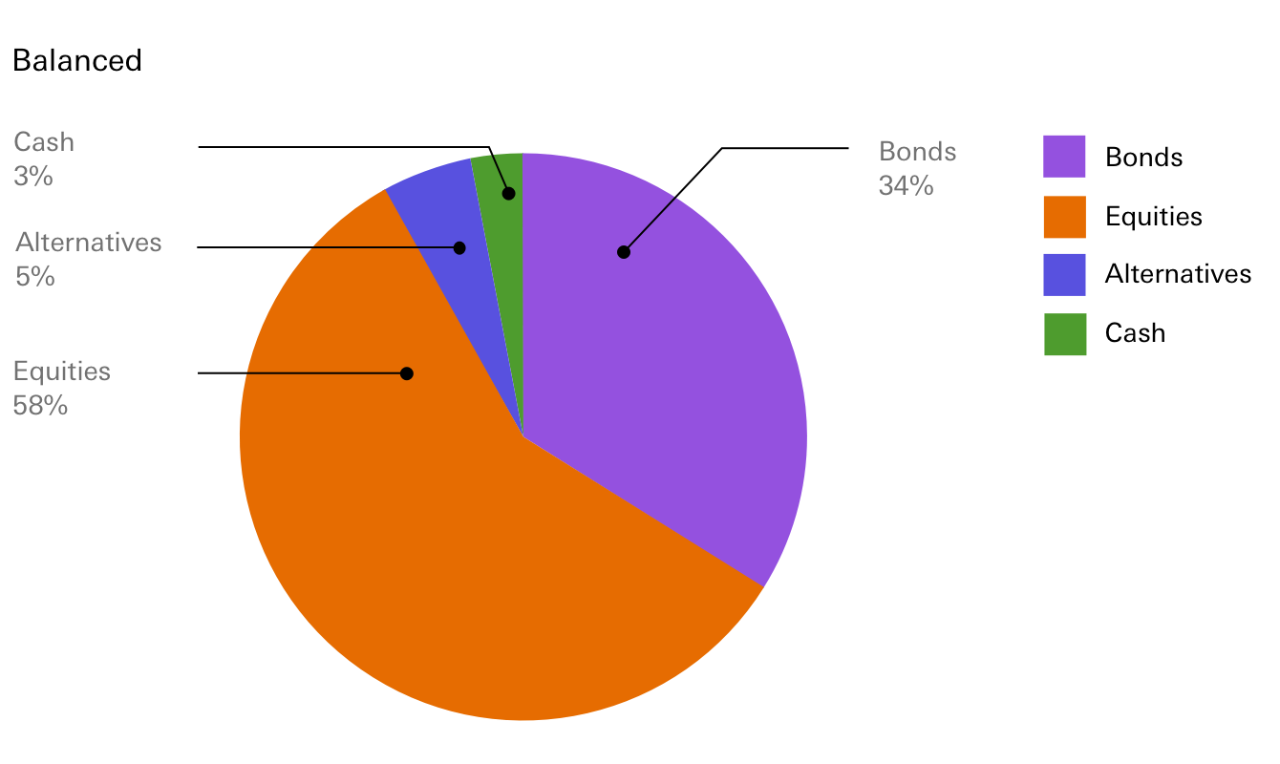

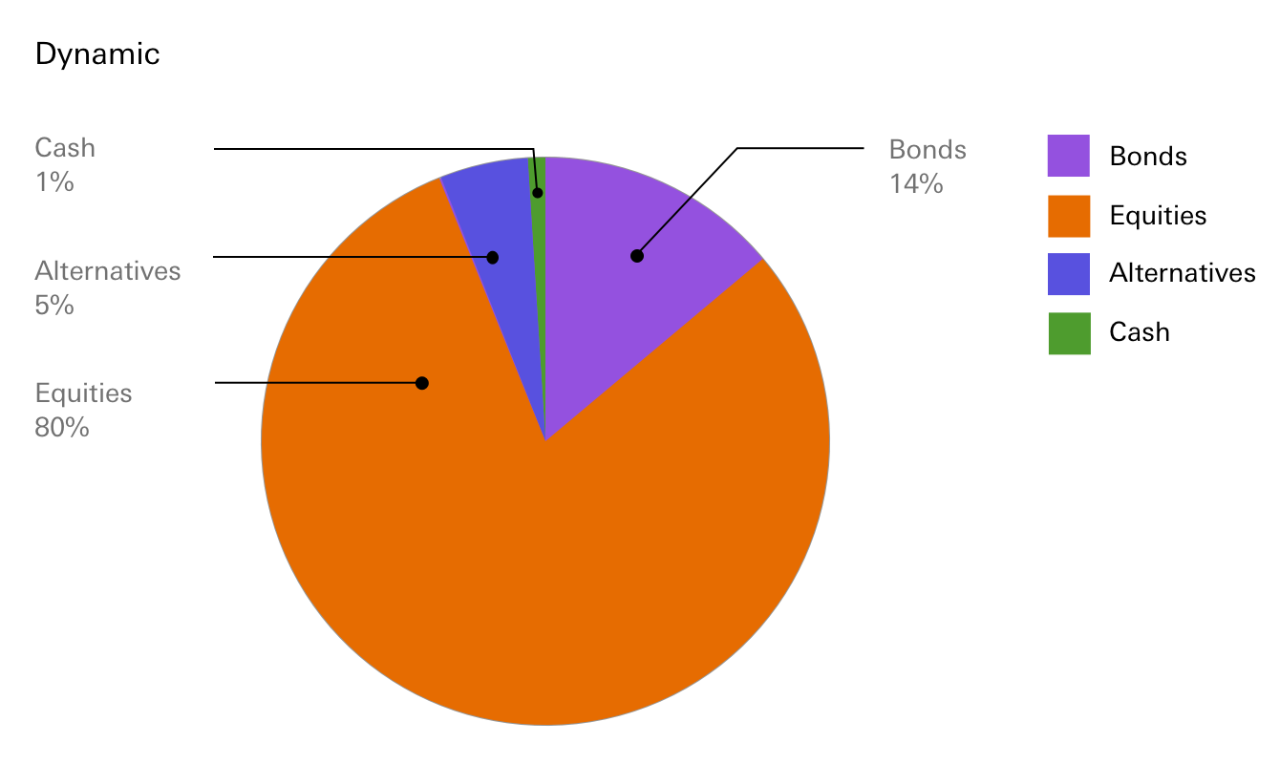

Our Global Strategy Portfolios are a suite of 5 multi-asset funds, each designed to match a specific level of risk. Whether you’re cautious or adventurous with your money, we’ve got a portfolio for you. All you need to do is choose your preferred level of risk and we’ll do the rest.

The portfolios are managed on your behalf by a team of investment professionals within Global Asset Management (UK,USA, Turkey)Head office. They monitor and manage the portfolios to get the best possible returns while staying within the designated level of risk– bringing you peace of mind that your investment will remain at the risk level you choose.

Remember that the value of investments and any income they generate can go down as well as up, meaning you may not get back what you invest. Exchange rate fluctuations can also cause the value of your investments to go down as well as up.

You can sell your investment to access your money at any time – however you should consider investing for at least 5 years.

Are you eligible?

You can invest via our Global Investment Centre if:

- you’ve $100 or more to invest

- you already have an account (excludes Online Bonus Saver and Fixed Rate Saver)

- you’re at least 18 years old

You can open a Global Investment Centre stocks & shares ISA if:

- you don’t already have a stocks & shares ISA for the current tax year and:

- you’ve not exceeded your ISA subscription limit for this tax year – currently $20,000 for 2019/20

Why invest in a Global Strategy Portfolio?

Easy to invest

- Choose from 5 portfolios

- Invest in a few clicks

- Start with as little as $100

- Top up or withdraw your money whenever you like

- Manage your investments via your online banking

Professionally managed

- Our Global Strategy Portfolios invest in US/UK and overseas investments

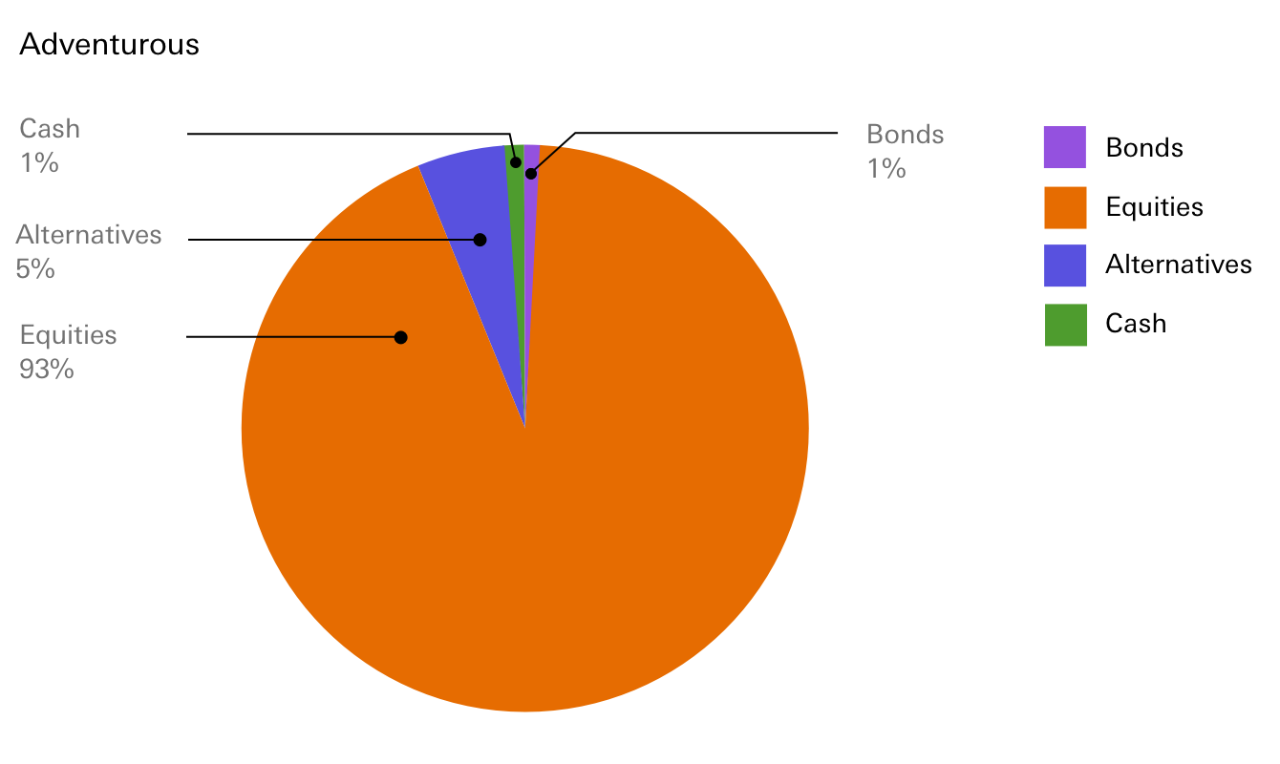

- Each portfolio contains a different mix of assets suitable for its level of risk

- They’re monitored and managed by investment professionals to ensure they remain at the described level of risk

How it works

When you choose to invest in a Global Strategy Portfolio, we take you through a streamlined application for our online fund platform, Global Investment Centre.

Once you’ve made your investment, you’ll have full access to the platform. This gives you access to around 400 other funds picked from a range of leading fund managers, as well as the Global Strategy Portfolios. And it means you can access, manage and top up your investment all via your online banking.

Bear in mind that our Global Strategy Portfolios and all the other funds in our Global Investment Centre are offered without investment advice. This means we aren’t required to assess the suitability of this product for you.

If you’re not sure about investing or how much risk is appropriate for you, please seek financial advice. To find out about getting investment advice from us, see our advice options.

Choose the portfolio that’s right for you

Click through the descriptions below to help you decide which of Global Strategy Portfolios might be right for you.

When you’ve decided on a portfolio, click the relevant button to choose the type account you want to apply for.

You can choose to invest via a stocks & shares ISA. Or, if you've maxed out your ISA allowance, you can invest via a general investment account.

If you’d like to invest via an ISA and a general investment account, simply choose which account to open first. You'll be able to open the other account as soon as you’ve made your initial investment.